Blogs

Utah adapts on the Income tax Incisions and Efforts Act of 2017 provision that give an excellent 100percent basic-seasons deduction on the modified base acceptance to own qualified property acquired and you may placed in services immediately after September 27, 2017, and you can ahead of January step 1, 2023.VANo. Texas does not follow the fresh Tax Incisions and you will Perform Work provision that give an excellent 100percent basic-year deduction on the adjusted foundation greeting to have licensed assets obtained and you may placed in provider immediately after Sep 27, 2017, and just before January step one, 2023.UTYes. Sc will not adhere to the newest Tax Incisions and you will Efforts Operate supply giving a great 100percent basic-season deduction for the adjusted base acceptance to have accredited assets gotten and you can listed in service once Sep 27, 2017, and you will before January 1, 2023. Oregon adapts on the Tax Cuts and you may Operate Act provision one provides a 100percent first-year deduction for the adjusted base welcome to have licensed property gotten and you can placed in provider just after Sep 27, 2017, and you will before January step one, 2023.PANo. North carolina doesn’t comply with the newest Income tax Cuts and you can Work Operate provision that provides a 100percent basic-season deduction for the modified base welcome to possess certified assets received and you will placed in solution immediately after September 27, 2017, and just before January step one, 2023.

- If the a taxpayer chooses the brand new 10-percent means, the newest taxpayer need to file an income tax come back to the put-in-provider season of the house you to definitely establishes when the tall work initiate.

- Awaken to 5000 from extra Free Margin to boost your own exchange power.

- Nonresidential structures had been over 30 % of one’s individual money inventory.

- Alabama adapts for the Income tax Slices and you can Perform Work provision you to definitely will bring a 100percent basic-12 months deduction to the modified basis invited for certified property acquired and placed in solution after September 27, 2017, and you can ahead of January 1, 2023.ARNo.

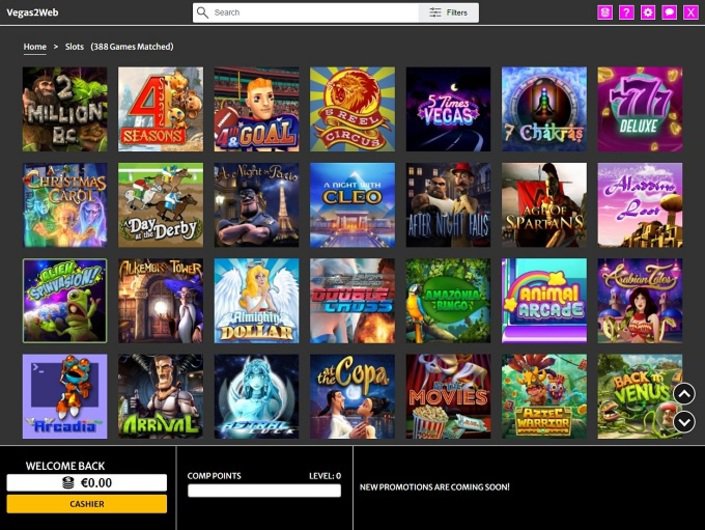

- Even as we don’t a bit enjoy the video game choice for it added bonus, it’s still free money, and exactly what’s greatest, you can gamble certain pretty personal titles inside it.

The newest Income tax Cuts and you may Work Act from improved the brand new allowable number of 50percent to 100percent of a qualified investment’s costs. Just after 2022, one to 100percent minimizes by the 20 commission issues up to they reaches 0percent in the 2027. Zooming inside the to the staff constitution, the newest writers “realize that extra led to a close relative escalation in the brand new shares of young, quicker educated, ladies, Black, and Hispanic experts. The fresh experts notice the performance suggest investment and you may development employees are subservient inputs inside modern creation.

Condition Decline Deduction Effects | casino netbet review

Most no-deposit incentives can be utilized for the all the casino games, whilst the video game contribution in order to wagering is different from you to definitely to another. Hence, it’s vital that you prefer a gambling establishment having a huge casino online game alternatives. Definitely listed below are some all of our the brand new directory of 75 100 percent free processor chip no deposit gambling enterprises, where you could explore free potato chips playing your preferred game. 100 percent free Chips try something which is quite unusual due to desk games’ large RTP. Because of this the best online casino websites are a lot more attending generate losses to your no no deposit black-jack extra one a no-deposit incentive to own slots. How they tasks are that the casino will provide you with a specific amount of revolves to have a choose gambling enterprise games.

Bonus Depreciation Compared to Point 179

So it applies to both business taxation and casino netbet review taxpayers which choose to file and you can spend the money for Michigan Team Taxation.MNNo. Arizona doesn’t conform to the new Income tax Slices and you will Work Work supply giving a great 100percent earliest-seasons deduction to your adjusted base acceptance to own certified possessions obtained and listed in solution immediately after Sep 27, 2017, and you will prior to January 1, 2023. When computing Arizona taxable income, an integrate-right back of every such decline a good taxpayer advertised for the their government go back is needed.

Its real time broker gambling enterprise is actually run on various other betting heavyweight, Advancement Betting. Rather than most other casinos, Jackpot Urban area distinguishes in itself from the integrating with only you to definitely app merchant — Microgaming — because of their usual casino games. Microgaming is among the top builders in the industry showing the gambling enterprise values quality more than quantity, and there is however an extremely significant five-hundred video game to explore. Centered all the way into 1998, Jackpot Urban area has become a first-price and you may reliable selection for participants, especially well-known inside the The newest Zealand and you will Canada. With well over 4,100000 video game, Casumo’s epic collection covers away from ports and you can desk game to reside local casino alternatives.

The newest starting point for deciding a great organization’s Ohio nonexempt earnings are federal nonexempt earnings. A corporation’s Ohio taxable money is actually the government taxable money once net operating-losings deduction and unique write-offs for the income tax 12 months to the changes.KYNo. The past laws follow the new August 2018 recommended regulations with a few adjustment.

Its headings are from a selection of finest app builders such as since the NetEnt, Play’letter Wade, Playtech, and you can Development Betting, certainly additional. Easily, the fresh gambling enterprise also has its own devoted application, where you could effortlessly accessibility such online game away from home. Family GOP players are now provided moving an extra tax bill “in the synchronous” on the Income tax Recovery for American Family and you can Pros Operate taking ”relief” in the 10,100 condition and you will regional income tax deduction limit.

To your a long-term basis, 100 percent bonus depreciation perform help business investment, money creation, and you may economic output along side long term while you are performing more opportunities for experts. Profile 1 illustrates the new erosion on the property value decline deductions and the ensuing higher taxation burden for a great four-year investment, such as semiconductor production gizmos, less than MACRS instead bonus decline. Since the a business is actually averted away from deducting a complete 100 within the genuine words, their tax bill is actually forcibly highest and the just after-tax cost of putting some funding is actually large. At the a higher once-income tax cost, a lot fewer financing opportunities is viable.

Prices Recuperation Out of Investment Property

Everything you see to the mobile application is largely a smaller-measurements of form of the newest pc web site, therefore it is simple for participants to find games which might be perfectly partioned into main groups. BetMGM Gambling enterprise have a tendency to ensure your bank account and if this is done you can make your first deposit and begin to experience. The fresh 1,100 put matches provide expires thirty day period immediately after completing the brand new account membership. Keep in mind that that is a basic illustration; lower than latest legislation, indoor developments so you can structures need to be depreciated more 39 years. Lawmakers would must consider simple tips to remove dated structures dependent ahead of complete expensing applied in addition to companies which have functioning loss. Provision of your TCJA, accounts for just 15 per cent of your own personal money inventory.

Excluded online game often is electronic poker, dining table video game, and several of your own higher return to pro harbors. Of a lot web based casinos and ban jackpot slots with the grand winnings prospective. Betting criteria are usually low for no put incentives compared to deposit suits incentives, between 1x wagering demands to help you 6x betting needs. Check always the benefit terms and conditions for the betting standards. Consider, either ten 100 percent free can be better than 20, if you’re able to’t fulfill the wagering demands to the bigger no deposit bonuses. So it incentive classification may include totally free revolves, no-deposit incentives, money back, and much more.